What the latest round of funding may mean for you.

The $900 billion Consolidated Appropriations Act of 2021 (2021 CAA) was signed into law by President Trump on December 28th as the COVID-19 pandemic continues to impact employers and employees. The new package resembles March’s $2.2 trillion CARES Act, but will only be $920 billion, with roughly half of that—$429 billion—being paid for with unspent CARES funds.

Here’s a quick recap of five key highlights:

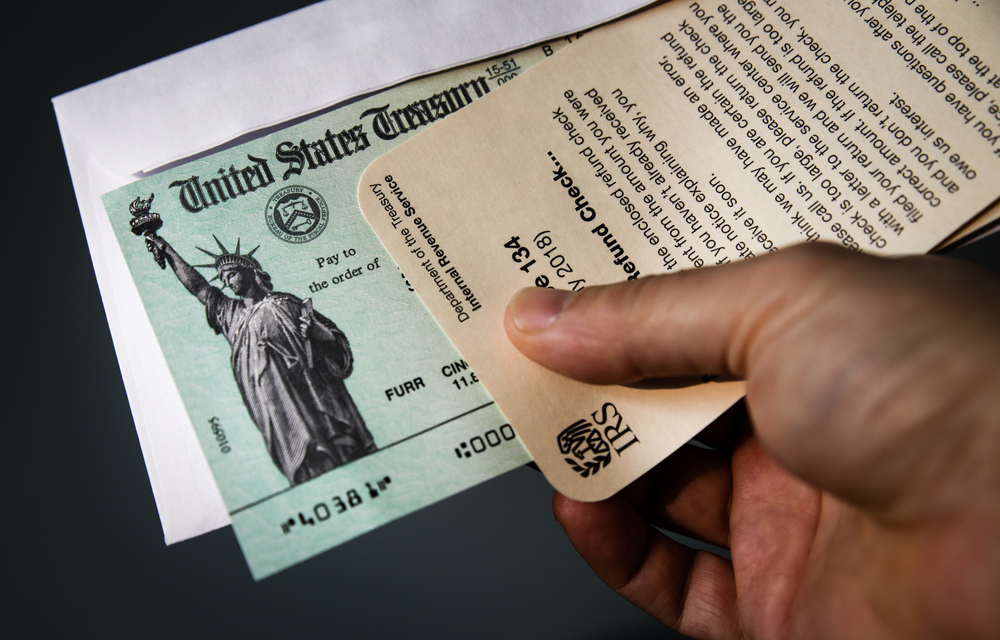

- Stimulus Checks

The new law authorized a second round of $600 checks for people with income that meets the criteria. The checks start to phase out for individuals who earned at least $75,000 in 2019 and $150,000 for married, joint filers.

Each dependent child under age 17 is also eligible for the $600 stimulus payment to the taxpayer claiming them on their taxes. But just like the CARES Act, adult dependents are left out—such as college students and disabled adults—amounting to an estimated 15 million people.

- Unemployment Benefits

The law provides up to $300 per week in federal benefits on top of state benefits through March 2021. The enhanced benefits also extend to self-employed individuals and gig workers.

An additional $13 billion has been put into SNAP benefits and food banks, among other programs, during one of the biggest hunger crises the U.S. has seen in years.

- Student Loan Repayment

The 2021 CAA extends the CARES Act provision that allows employers to repay up to $5,250 annually towards an employee’s student loan payments. The payments are tax-free to the employee. There is no data yet about how many employers have actually implemented this benefit.

- Small Businesses

The 50% limit on the deduction for business meals has been lifted. Business meal expenses after December 31, 2020, and before January 1, 2023, may now be fully deductible. Please consult your tax, legal, or accounting professional for more specific information regarding this provision.

- PPP Loans

The new law contains $284 billion in relief for a second round of Payment Protection Program loan funding, with some loans eligible for forgiveness. Businesses with 300 or fewer employees may be eligible for a second loan. “Second-draw” loans are available through March 31, 2021

The bill also includes $20 billion in grants for companies in low-income areas and money set aside for loans from community-based and minority-owned lenders.

###

This article is as accurate as our research sources (below), but it is to be used for informational purposes only and is not intended as financial advice. Consult with your tax, legal and accounting professionals before taking any action based on this information.

Like with any new legislation, as 2021 gets underway expect additional guidance from regulators on 2021 CAA. Our office will keep an eye out for updates and pass information as it becomes available.

Call us if you have any questions. You can reach Roberts Tax and Retirement Planning in Gilbert at 480.270.2802.

Sources:

https://www.forbes.com/advisor/personal-finance/do-adult-dependents-get-the-second-stimulus-check