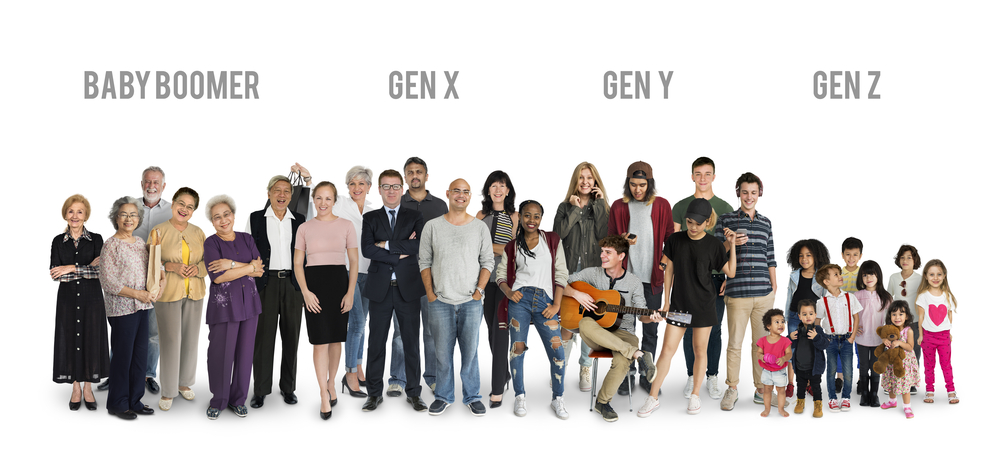

While it’s true that each person is unique and every financial plan should be customized according to their situation, it is generally accepted that people should start saving for retirement early in their lives so they can take advantage of compounding returns.

Here is some general information and things to consider about saving for retirement for each age group.

Gen Z

Roth IRA accounts. As soon as children or grandchildren have earned income, either you or they can open and contribute to a Roth IRA (Individual Retirement Account) in their name. Roth IRA contributions can’t exceed the child’s earned income and the maximum amount that can be contributed for the year is $6,000 for 2021. The benefit is that Roth accounts grow tax-free as long as all IRS rules are followed. After the account has been open for five years, any amount contributed can be borrowed or taken out for any reason without any taxes or tax penalties due. (But Roth IRA account earnings—meaning returns or interest credited—can’t be taken out before age 59-1/2 without a 10% penalty.) That means your child could have a very flexible way to borrow for college, down payment on a house or any other purpose—including retirement—later on.

Permanent life insurance. Another option to help children, teens and young adults save for retirement is permanent life insurance. New types of life insurance policies can be a tax-advantaged way to save and borrow later from the policy for retirement, college or any other purpose. Often the cost of insurance is very low for healthy young people.

Gen Y

Workplace retirement plans. People in their mid-20s to 40s are often pursuing careers where their employers provide 401(k) or similar retirement plans with a “match” for contributions. One rule of thumb says to max out pre-tax contributions during these years up to the maximum match by your employer; you get the added benefit of lowering your taxable income.

Traditional IRA accounts, Roth IRAs, permanent life insurance, investment portfolios. For those who don’t have a workplace retirement plan, or for those that want to invest beyond their employer’s group retirement offering, traditional pre-tax IRAs are available depending on your income level while providing a tax write-off, while tax-advantaged Roth IRAs and permanent life insurance can offer other benefits. Once you reach the maximums on retirement savings, you may want to begin to invest in stocks and bonds, forming your first investment portfolio. If possible, hire a financial professional to help you create a complete financial plan which can be updated and reviewed every year.

Gen X

Save, invest, and save some more. People in their 40s and early 50s can be sandwiched between providing for their older children’s expensive needs—like transportation, health care and college—while caring for their parents as they get older. Yet it is incredibly important for Gen X to begin to maximize their retirement savings. All of the possibilities discussed for younger ages also apply to Gen X, and after age 50, you can contribute $7,000 per year ($1,000 extra) to an IRA or Roth IRA in 2021, depending on your income and IRS rules. Some permanent life insurance or deferred income annuity products can allow you to save for retirement while providing other optional benefits like disability, long-term care insurance or spousal protection should you need it. Find efficient ways to pay for your kids’ college, and as you make more money, use it for retirement investing while keeping your spending on housing, automobiles and similar items as low as you can. Work closely with your financial professional to make sure you are on track to achieve your retirement goals.

Baby Boomers

How much money will you need to retire? If you are 55 or older, it is probably time to get serious about what you want your retirement lifestyle to be so that you can get some idea of what kind of retirement savings you will need to support yourself after you are no longer receiving a paycheck. For instance, someone who wants to do a lot of international traveling will need a lot more saved than someone who plans to stay close to home during retirement. Retirement planning is essential, since pulling money out of your portfolio is much different than putting money in as you have been used to. Make sure your financial professional is focused on retirement; retirement planning is a distinct specialty.

Claiming Social Security. It’s time to start learning about Social Security. The Social Security Administration recently changed the design of your statement to show you how much your benefit will be at the earliest time you can file (age 62), at full retirement age (around age 66 or 67 depending on your birth year) and at age 70, when your benefit amount stops growing. You can obtain your latest statement here. Important: Remember that Medicare is not free; premiums come out of your Social Security check.

Consider taxation. Remember that if you have the majority of your retirement savings held in taxable accounts like traditional 401(k)s, you will owe income taxes on that money. Depending on your tax bracket, your savings may actually be from 22% to 35% less after you pay income taxes. As an example, someone with $500,000 saved for retirement may actually only have $385,000 if they are in the 23% tax bracket. Current tax law requires you to start withdrawing money and paying income taxes on taxable, tax-deferred retirement accounts every year beginning at age 72. Start working with your financial professional early, because there may be ways to save on taxes for the long-term using strategies over the five to 10 years preceding retirement.

Multigenerational Wealth

As part of retirement planning, it is important that each member of the family works together for tax-efficient wealth transfer in the future, minimizing the chance for strife, confusion or excess taxation during family transitions or adverse events. New legislation—the SECURE Act—changed the rules about inherited traditional IRA accounts, and potential tax impacts should be addressed now rather than later.

The family that plans together, stays happy together, hopefully for the long-term. Whenever possible, everyone should be involved in financial, retirement and estate planning matters working hand-in-hand with a trusted financial professional, tax professional and estate attorney to document inheritance matters, final wishes, health care directives, wills and trusts.

If you have any questions about this article, please call us. We’re happy to help you and your family members. You can reach Roberts Tax and Retirement Planning in Gilbert at 480.270.2802.